This Scientist Is Auctioning Off His DNA and Says Yours is Valuable Too

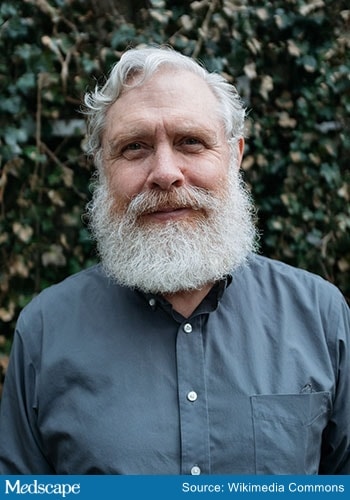

George Church’s genes are making history again. The Harvard geneticist was one of the first people to ever have his genome sequenced, and now he is auctioning it off to the highest bidder.

George Church’s decision to share his personal genetic information is stoking controversy in the scientific community.

This isn’t the first time Church has made headlines; the cofounder of Nebula Genomics was among the first people to post all 3 billion of his DNA base pairs online as part of the Personal Genome Project. His DNA has already been used in countless studies, and he has now put his full genome sequence on the auction block for sale.

Church’s goal, according to Nebula’s cofounder and CEO Kamal Obbad, is to highlight how blockchain technology can help people realize the value of their own DNA.

The transaction will take place using a type of blockchain technology called a nonfungible token (NFT), which is a unique digital token for a one-of-a-kind item and acts as proof of ownership.

The NFT for Church’s genome will consist of the digital location of his full genome, along with high-resolution digital art representing his DNA and likeness. Although the artwork has yet to be finalized by a Nebula artist, other creations by the team show modern, minimalist artwork inspired by a person’s DNA. Bidders will most likely be collectors looking to own a slice of history, Obbad says.

Genome-based research is designed to develop tools to better predict diseases and treat them on the basis of a person’s genetic make-up.

This will be the first NFT for a genome, according to Obbad, and it represents a case study of what the future of shared genomic data could look like.

“With NFTs, you can take ownership of your data. You can choose how you want to sell those data or how you want to be compensated and track who has access to your data,” Obbad says.

The move is meant to kick start a conversation about how people can share and sell their own genetic information in a transparent and secure format, he adds.

This is a departure from the current DNA testing business model, which has reaped billions in revenue for large corporations like Ancestry and 23andMe without sharing the profits with the people who made their success possible, according to Forrest Briscoe, PhD, a professor at Penn State Smeal College of Business in University Park, Pennsylvania.

“People don’t understand the value of their data and how they’re being used,” Briscoe says, adding that this effort could be a way for everyday people to begin to cash in on the DNA testing juggernaut.

DNA testing is big business. Just ask Blackstone, the private equity firm that acquired Ancestry for $4.7 billion in December 2020. What commanded those big bucks wasn’t the company’s services that help genealogists build their family tree, but rather the database of DNA from Ancestry’s 18 million users. That comes out to about $250 per individual genome.

Big Business

Companies like 23andMe and Ancestry have made their money not by selling DNA testing kits, which cost about $100 each, Obbad explains. Rather, they sell these kits at a loss and provide a report on the tester’s genotype in exchange for their valuable genetic information. The real money is made by selling access to the sequences they have collected, along with their accompanying health surveys, to pharmaceutical companies, researchers, and other entities. In July 2018, British pharmaceutical company GSK (formerly GlaxoSmithKline) bought a $300 million stake in 23andMe.

Both Blackstone and GSK deny that their moves have harmed patient privacy.

“As we’ve said repeatedly, Blackstone has not and will not access user DNA and family tree data, and we will not be sharing this data with our other companies. To be crystal clear, doing so was never part of our investment thesis, period,” said a Blackstone spokesperson.

GSK reports that about 80% of 23andMe customers opt to participate in research. The company says that it and 23andMe take the privacy and security of all their data very seriously. “No one genetic data point from a single individual will lead to a new medicine and no individual level data is personally identifiable as part of the GSK–23andMe collaboration. Only summary statistic aggregated genetic data is shared with GSK. Personal identifiable information is stored separately from genetic data and in line with industry standards for security.”

Yet the acquisitions by Blackstone and GSK spurred the stirrings of a movement for everyday users to retake some of the profits.

The first major hurdle that has to be overcome is finding a large-scale platform where people could securely sell their DNA sequences to the companies and researchers of their choice. The second is figuring out how to quantify what a “just and fair compensation” should be for a genome, according to Elizabeth Ford, PhD, senior lecturer in primary care research at Brighton and Sussex Medical School in the United Kingdom.

“The problem with genetic data is nobody knows quite what it might lead to and how much money some company might make from it in the future” says Ford.

Most DNA used in research studies comes from individual people who donate out of a sense of generosity and altruism without expectation of compensation. People have generally been happy to share their data, says Tina Woods, cofounder and chief executive officer of Longevity International, which is spearheading the Open Life Data Framework to meet the government goal of adding 5 healthy years to the lives of Britons.

“We do it all the time with Google and Facebook,” she says.

The expectation is that the scientists will maintain an individual’s privacy and that financial profit isn’t the goal. As the potential for large paydays rises, however, more and more of our genetic information will have financial strings attached, according to David Koepsell, JD, PhD, cofounder and CEO of EncrypGen.

A DNA sequence on its own isn’t nearly as valuable as it is when buyers also have access to the accompanying medical information, which can include everything from our preferred bedtime to details about our family history of heart disease and cancer.

“Big companies will know everything, including our address and credit card information,” Koepsell says.

Give Me $95

Users are beginning to realize the value built into their DNA, according to a 2020 survey conducted by Briscoe and his colleagues. Of the more than 2000 people surveyed, only 11.7% said they were willing to donate their genetic sequences to scientists, and 37.8% said they wouldn’t share their data at any price. The remaining half said they would be willing to sell their DNA for an average price of $95.

“I’ve been studying this area for 4 years, and if you told me I had to assign a value to my DNA, it would be a challenge,” Briscoe says.

To sell your own DNA, however, you need a platform to keep it secure. Both Nebula Genomics and EncrypGen have turned to blockchain to build a bridge between an individual’s genetic sequence and potential buyers.

NFTs have been used to store Twitter founder Jack Dorsey’s first tweet; bids for it reached $2.5 million even though it is publicly available online. An NFT also holds an animated GIF of Nyan Cat, the Pop-Tart cat meme that sold for 300 ether, the cryptocurrency of the platform, which is currently estimated to be worth more than $1,000,000.

An NFT serves not only as a certificate of ownership, it also provides a record of everyone who has bought and sold the NFT on the blockchain. An NFT doesn’t keep someone from stealing the digital piece, but it does provide proof that the person owns the original work.

Therein lies the rub. “None of these technologies solve any of the real problems,” Koepsell says. “Creating an NFT out of genomic data doesn’t give you any rights to the data.” Without a legal way to recognize those rights, the field can’t move forward.

The auction of Church’s genome hasn’t yet been completed, but Obbad says that the effort creates a major step forward in the fight against the “obscure and opaque system” that currently governs DNA sequences.

“The real way companies are making money is by monetizing data, it’s not by making a good product they sold to happy customers,” he said.

Carrie Arnold is an award-winning public health journalist living in Virginia. Her work has appeared in the New York Times, National Geographic, New Scientist, Scientific American, and Nature, among others. She is currently a Knight Science Journalism fellow at MIT and is working on a book about the multigenerational effects of a Michigan chemical disaster.

Follow Medscape on Facebook, Twitter, Instagram, and YouTube

Source: Read Full Article